Financial Strategies

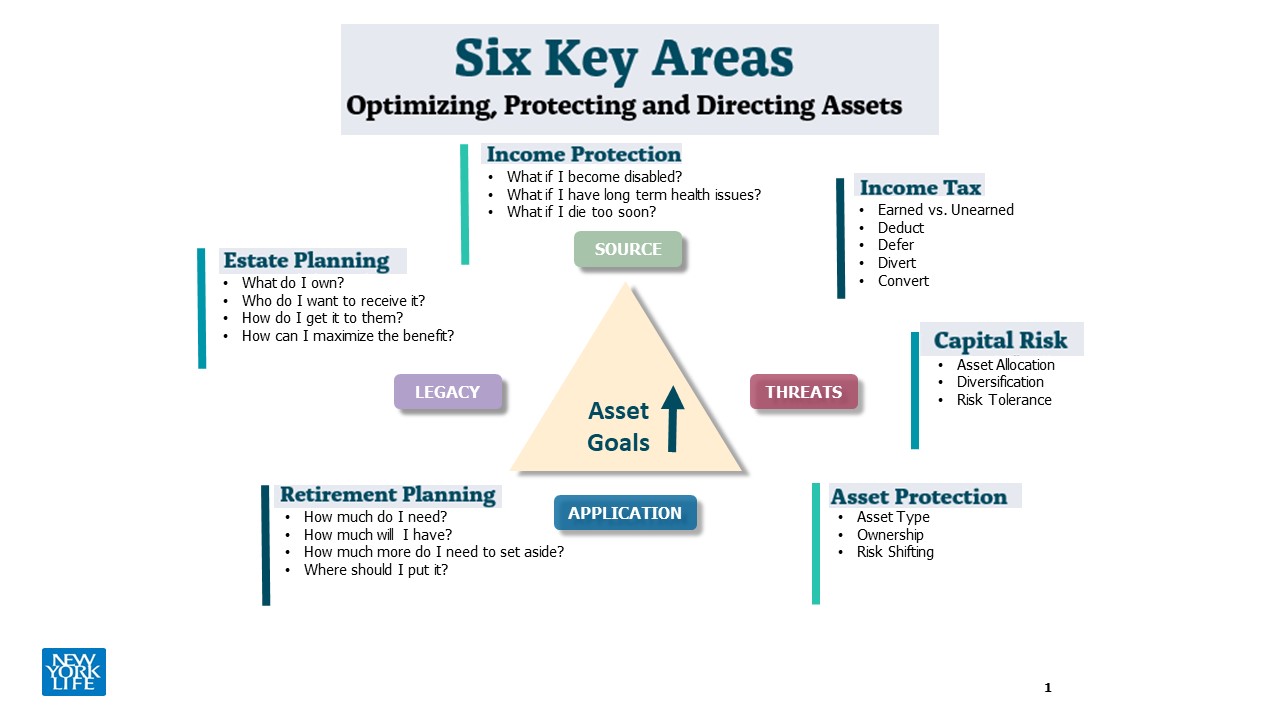

Long-term financial success does not happen on its own. It requires careful planning to lay the foundation for a secure future and deal most effectively with ongoing financial challenges.

At Eagle Strategies LLC we provide customized financial and insurance solutions designed to help you meet your unique financial goals.

| Protection | To determine if you, your family, and/or your business is properly protected from premature death, disability, or a long-term care event. |

| Retirement | To identify, plan for, and implement necessary saving and diversification of tax advantaged retirement solutions to help you achieve financial independence and address your longevity concerns. Follow this link to test your Retirement IQ |

| Investment | To help you achieve your short or long-term financial goals by customizing solutions based on your individual goals, risk capacity, risk tolerance, and investment time horizon. |

| Business | Each of the objectives of the entrepreneur's business plan affect aspects of their personal financial plan. Only an integrated approach to personal and business planning incorporating can adequately address entrepreneurs and their unique insurance, investment and tax planning challenges. |

| Estate Planning | To assure you have an orderly process and necessary documentation to implement your plans in place to assure your family, your business, and your financial goals are addressed during your life, if incapacitated, and after your death. |

We will help you take a detailed look at your current situation, assess your long-term objectives, and develop a roadmap to bridge the gap from where you are today to where you want to be in the future.

Advanced Life Insurance Planning

Life insurance can be the most powerful tool in the financial toolbox. Unlike any other financial instrument, it buys you time. You pay installment premiums for a fraction of the ultimate insurance benefit (often pennies on the dollar), and whenever you pass away the death benefit is created for your beneficiary.

When structured properly, life insurance death benefits are income tax free and the cash values can be accessed tax free, thus making it an appropriate solution for a variety of challenges that you or your family may face.

As an Eagle Strategies Financial Adviser, I have access to the Advanced Planning Group - a premier planning team of New York Life Insurance Company with expertise in law, accounting, and insurance — who can assist you with your business and estate planning needs.

The flexibility of modern life insurance products help you manage the risk you face today and your planning needs tomorrow. You can calculate how much life insurance protection you may need:

- Family Protection - provides a source of cash for your surviving family members to help them with ongoing living expenses.

- Estate Tax Liabilities - Life insurance can offer a substantial discount for the estate tax liability and provide liquidity to pay off indebtedness that prevents assets from passing on in a untimely manner.

- Estate Equalization - Insurance proceeds can be used to balance the distribution of assets to your heirs if necessary or desired.

- An Alternative Asset Class - Life Insurance cash values grow tax-deferred, at a bond-like rate of return and with less volatility. These values can be accessed tax-free as long as you follow IRS guidelines, for:

- Supplemental Retirement Income - Life Insurance can be designed to provide tax free retirement income and a potential hedge against higher income tax rates.

- Alternate Asset Class - The tax free internal rate of return (IRR) at death can be an attractive investment for your balance sheet.

- Debt Protection - Life insurance proceeds can be used to pay off existing and future debt obligations.

Consider health, friends and financial back up plans

It’s easy to see retirement as the natural solution to job dissatisfaction, especially given how much pressure so many of us are under at work these days. But the truth is that not everyone needs to or should want to retire. Follow this link to test your Retirement IQ.

This path is windy and uneven, and unmarked in places. You may be reaching the top of the proverbial financial mountain, but transitioning to the downhill side may present some different challenges (especially to your aching knees). It’s more like a windy maze at times than a large, wide-open thoroughfare with well-marked exits. Whatever you are carrying is going to put more pressure on your knees and lower back. You will be thankful that you have a hiking pole or two for stability. (follow this link for a copy of my paper on the 10 Retirement Questions to Think about First

And, wouldn’t it be nice to have a Financial GPS in your pocket, that could provide you with turn-by-turn instructions as you make this transition to true financial independence? Our website was built to be your own Financial GPS, because we each have different life events and family dynamics to consider as we navigate our way forward.

The amount you will need in retirement depends on the age you plan to retire, your desired retirement lifestyle, how long you expect to live and the rate of return that you expect to earn on your investments. Social Security and employer-sponsored pension plans will probably provide less of what you will need than they did for your parents.

Follow this link to learn more about how you can maximize your retirement income:

- Clearly prioritized retirement goals and objectives

- Retirement at a later age

- Saving more

- Spending less during retirement

- Invest to earn a potentially higher rate of return on investments while still feeling comfortable with the level of risk involved

- Liquidation of non-cash assets

- Social Security

- Maximize contributions to qualified retirement plans

- Invest in IRA

Eagle Strategies Investment Advisory Services

Expertise and Advanced Planning Support

I offer financial planning and Investment advisory services through Eagle Strategies, LLC, A Registered Investment Adviser, and a variety of life insurance, long term care insurance and annuities through our affiliation with New York Life and other insurance companies; as well as investment products that can help you meet your financial goals.

The Value of Human Capital

Like most savvy investors, you probably turn to a balance sheet of financial assets such as stocks, bonds, mutual funds, real estate holdings, and retirement savings accounts to calculate your financial net worth. This traditional definition of wealth, however, is incomplete as it overlooks what may be your largest asset – how you convert your "human capital" into your Return on Life.

Human capital is the value of all your expected future income, including your Social Security benefits and pension income. By considering your current income, your savings rate, and your work or retirement situation we help you to determine how large an asset your human capital is for you and its effect on your overall asset allocation.

Your human capital should drive insurance selection and asset allocation decisions in pre-retirement and retirement. In pre-retirement, you incorporate insurance into your asset allocation to help mitigate risk and enhance the economic value of your portfolio. In retirement, you might consider incorporating guaranteed lifetime income* to hedge against the risk of outliving your retirement savings.

Several Experts Offer One Comprehensive Solution

Eagle Strategies provides managed account solutions that provide you with all the benefits of a comprehensive investment management service and access to an extensive universe of mutual funds, fund advisory portfolios, and separately managed account managers all tailored to your needs in a simplified approach focused on maximizing value over your entire lifetime.

This service marks a unique advance in wealth management by bringing together an innovative approach to insurance product selection and rigorous investment management from several third party money managers to create an integrated investment and insurance strategy to help meet your financial goals - the same portfolio management services many institutional investors receive.

For a free Investment Advisory consultation please contact me today!

* Refers to fixed annuity products. Guarantees are backed by the claims-paying ability of the issuer.

Education planning for your children can be a major financial consideration. Planning early allows you to take advantage of the time value of money and help minimize the savings requirement.

- Prioritize your education objective with your insurance needs, retirement needs, major purchases and current income needs

- Consider the various education funding accounts -- Qualified State Tuition Plans (also known as 529 Plans#), Uniform Transfer to Minor Accounts (UTMA) / Uniform Gifts to Minor Accounts (UGMA), Coverdell Educational savings accounts and prepaid tuition plans.

- 529 Higher Education Chart

- Ensure college expenses are properly planned -- include tuition, room and board and living expenses. Factor in an inflation rate for the rising cost of tuition. Should you consider planning for post-graduate studies? Do you expect your child/children to receive scholarships or financial aid?

Wealth Preservation/Estate Planning

- Minimizing income and estate taxes

- Transferring wealth from one generation to the next

- Developing charitable gifting strategies

- Aligning existing portfolios and retirement accounts with your estate plan

Gifting strategies may be used as a means of distributing your estate and effectively reducing estate taxes upon death. Most taxpayers can accomplish significant estate planning objectives simply by taking advantage of lifetime giving which includes making maximum use of the annual exclusion, lifetime use of the applicable exclusion amount and lifetime taxable gifts.

Considerations should be given to one or more of the following strategies when trying to minimize estate taxes and maximize the net distributions from your estate to family, friends and charities:

- Grantor Retained Trusts - allows you to remove appreciating property from your estate thus reducing estate taxes. Once the property is transferred to the trust, the grantor (donor) retains interest in the property for the term specified. The grantor receives payments based on the value of the assets in the trust. The property, including any appreciation in value, passes to the beneficiaries without further gift or estate tax consequences.

- Charitable Remainder Trusts - allows you to donate property and assets to a trust and reserve an income stream in the trust for a specified period. The trust provides an income to you or any designated non-charitable beneficiaries with the remainder interest being transferred to a qualified charity at the end of the term.

- Charitable Lead Trusts - allows you to designate charities to receive an income stream during term of the trust. At the end of the term, the ultimate beneficiaries are your heirs.

Contact Us For More Information

Please be sure to consult your tax advisor & attorney regarding your particular situation.

#Securities offered through NYLIFE Securities LLC. (member FINRA/SIPC, NYLIFE Securities LLC is a New York Life company).

*Neither Eagle Strategies LLC nor any of its affiliates provide legal, tax or accounting advice. Please contact your own advisors for more information on your particular situation.

|

|